Jurisdiction

Pursuant to Section 12 of the Tax Court of Canada Act, the Court has exclusive original jurisdiction to hear and determine appeals and references to the Court on matters arising under the following Acts:

- Income Tax Act

- Employment Insurance Act (formerly the Unemployment Insurance Act)

- Part IX of the Excise Tax Act (GST)

- Canada Pension Plan

- Old Age Security Act

- Petroleum and Gas Revenue Tax Act

- Cultural Property Export and Import Act

- Customs Act (Part V.1)

- Air Travellers Security Charge Act

- Excise Act, 2001

- Softwood Lumber Products Export Charge Act, 2006

- War Veterans Allowance Act

- Civilian War-related Benefits Act

- Section 33 of the Veterans Review and Appeal Board Act

- Disability Tax Credit Promoters Restrictions Act

- Greenhouse Gas Pollution Pricing Act

- Underused Housing Tax Act

- Select Luxury Items Tax Act

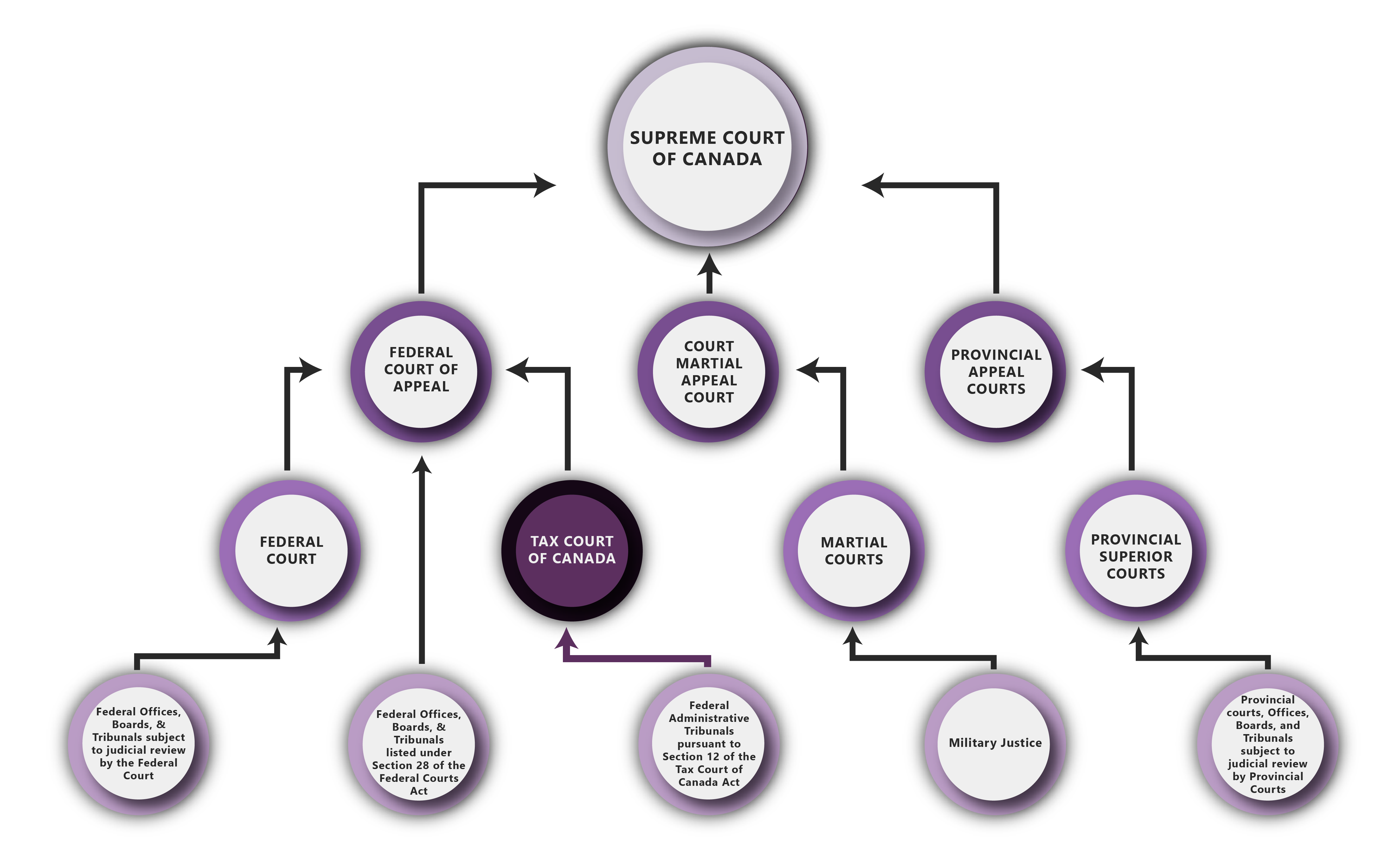

Canada’s Court System

Canada’s Court System - Text version

This chart provides an overview of the hierarchy of Canada’s Court System. It is arranged as follows:

- Supreme Court of Canada

- Federal Court of Appeal

- Federal Court

- Federal Offices, Boards, & Tribunals subject to judicial review by the Federal Court

- Tax Court of Canada

- Federal Administrative Tribunals pursuant to Section 12 of the Tax Court of Canada Act

- Federal Offices, Boards & Tribunals listed under Section 28 of the Federal Courts Act

- Federal Court

- Court Martial Appeal Court

- Military Courts

- Military Justice

- Military Courts

- Provincial Appeal Courts

- Provincial Superior Courts

- Provincial Courts, Offices, Boards, and Tribunals subject to judicial review by Provincial Courts.

- Provincial Superior Courts

- Federal Court of Appeal