The first step is to send your Notice of Appeal to the Court. You may do so electronically, in-person, by mail or by fax. The Notice of Appeal may be in the form set out in Schedule 4 , but a letter is also acceptable as long as it sets out, in general terms, the reasons for the appeal and the relevant facts such as the date of the assessment or assessments, the taxation years or GST periods at issue. You must also include your address for service and you are encouraged to provide your email and phone number.

Frequently Asked Questions

The TCC is a Superior Court of Record established pursuant to the Tax Court of Canada Act, before which individuals and companies may litigate against the Government of Canada on matters arising under legislation wherein the Court has exclusive original jurisdiction. The majority of the appeals to the Court relate to Income Tax (IT) under the federal Income Tax Act and Goods and Services Tax (GST) under the Excise Tax Act.

You may appeal to the TCC once you have exhausted all available administrative avenues. Before appealing to the TCC to resolve an Income Tax or GST dispute, you must first send a "Notice of Objection" to the CRA. The review of your Notice of Objection by the CRA will result in a Reassessment, a Confirmation or a Determination.

If you do not agree with the CRA's response to your Notice of Objection, you have 90 days from the date of the CRA's Reassessment, Confirmation or Determination to appeal to the TCC. You may also appeal to the TCC if the CRA does not respond to your Notice of Objection within 90 days for an Income Tax (IT) matter or 180 days for a GST matter. Please use the When Can I Come to the Tax Court of Canada tool to find out if the Tax Court is the right place for you to come and if so, which document you can file.

If you have received a ruling from the Minister of National Revenue under the Employment Insurance Act (EI) or the Canada Pension Plan (CPP) and you do not agree with the Minister's decision issued by the CPP/EI Appeals Division of the Canada Revenue Agency (CRA), you may appeal to the TCC. You have 90 days from the date of the Minister's decision to appeal to the TCC. If you are unable to submit your appeal within this 90-day period, you must, within 90 days after the initial period expires, apply for an extension of the time to appeal.

For information on other types of appeals within the Tax Court’s jurisdiction, you are encouraged to contact us.

The Registry has been established by the Chief Administrator of the Courts Administration Service (CAS) pursuant to the Courts Administration Service Act. The TCC Registry provides administrative services to the Court, the parties, and the general public. The Registry plays a central role in the Court’s operations. It is responsible for processing, recording and directing the flow of all documents filed by the parties. The Registry is the point of contact between the parties and the judges. If you have any procedural questions about your matter, you may contact the Registry and they can assist you. However, please note that the Registry cannot provide legal advice. The Court has Registry offices across the country. To see the closest office near you, please use the Find Us tool.

The TCC is independent of the CRA and all other departments of the Government of Canada. The TCC only has access to documents submitted to the Court by the parties. The TCC does not have access to CRA’s records.

The TCC requires registry and judicial services in order to function properly. There are many employees working behind the scenes to ensure judges can do their work as effectively as possible. When you work at the Tax Court of Canada, you see first-hand how your work affects Canadians every day.

There are two main branches you could work in: the registry services and the judicial services. In the registry, the positions are mostly support clerks, registry officers and hearings coordinators. The judicial services positions mostly include judicial assistants and law clerks. For more information, please visit our careers page.

The Registry of the Tax Court of Canada is open from 8:30 a.m. to 4:30 p.m., Monday to Friday. Please be mindful of federal and provincial holidays which may impact hours of service.

You can appeal to the Tax Court of Canada by filing a Notice of Appeal, an Application for Extension of Time to file a Notice of Appeal, or an Application for an Extension of Time to file an Objection. The forms are available on the forms page. Once completed, you may submit the document online through the electronic filing system or in person, by mail, or by fax to one of our Registry offices. We encourage you to file your documents electronically. There are no additional costs associated with electronic filing. If completing the form on a computer is not possible, please contact the Registry for more information.

An Application is made when you are late in filing either an objection before the Minister of National Revenue or an appeal before the TCC (i.e after the prescribed time limits). An Appeal is made before the TCC when you are within the prescribed time limit to file an Appeal with the TCC.

If you do not agree with the CRA’s decision, you have 90 days from the date of the CRA's Reassessment, Confirmation or Determination in which to file an appeal to the TCC. You may also appeal to the TCC if the CRA has not responded to your Notice of Objection. For Income Tax matters, you may appeal if the CRA has not responded within 90 days of the date of filing of your Notice of Objection. For GST matters, you may appeal if the CRA has not responded within 180 days of the date of filing of your Notice of Objection. If you are out of time, you can file an Application for an Extension of Time to file a Notice of Appeal, if it is applicable to you. Please use this When Can I Come to the TCC tool to find out if the Tax Court is the right place for you to come and if so, which document you can file.

Appeals under the General Procedure are subject to a number of formal procedures and legal steps. A copy of the TCC Rules may be required to help you follow the entire process. The Rules may be consulted electronically or obtained from any TCC Registry office.

Under this procedure, formal court procedures are closely followed. When appealing under the General Procedure, you may represent yourself or be represented by a lawyer. A corporation must be represented by a lawyer. It is also important to note that there are three (3) different classes of filing fees under the General Procedure. (see question "What are the filing fees for the General Procedure?").

For Income Tax and Goods and Services Tax appeals:

-

Class A

- an appeal where the amount in issue is less than $50,000

- for appeals in which a loss has been determined, where the amount of loss in issue is less than $100,000

- the filing fee is $250

-

Class B

- an appeal where the amount in issue is $50,000 or more but less than $150,000

- for appeals in which a loss has been determined, where the amount of loss in issue is $100,000, or more but less than $300,000

- the filing fee is $400

-

Class C

- an appeal where the amount in issue is $150,000 or more

- for appeals in which a loss has been determined, where the amount of loss in issue is $300,000, or more

- the filing fee is $550

Payment of these fees may be made in cash, by cheque or by debit/credit card. When filing electronically or by fax, you may pay by credit card by communicating with the Registry by phone and providing your credit card information. Cheques must be made in Canadian funds payable to the Receiver General of Canada.

If an Appellant is unable to pay the filing fees under the General Procedure and does not want to limit the amount at issue in order to proceed under the informal procedure (for which there are no filing fees), the Appellant may send a letter to the Court requesting that the filing fee for their case be waived. The Appellant must detail why they are unable to pay for this fee and any undue hardship that may fall upon them if they were to pay the fee.

Documents filed with the TCC and all evidence received by the Court are generally public records open to inspection by the public, unless on motion, the Court issues a confidentiality order pursuant to 16.1 of the Tax Court of Canada Rules (General Procedure).

Redaction is your responsibility. For your security, all of the following information should be removed from all documentation you wish to submit to the Court.

- Social insurance number or employee identification number

- Business number

- GST or HST account number

- Payroll account number

- Date of birth (unless it must be provided, in which case only the year must appear)

- Names of minor children (unless they need to be identified, in which case only the child’s initials must appear)

- Medical information not relevant to the disposition of the proceeding

- Bank number (unless it needs to be provided, in which case only the last four digits must appear)

The Court may order that certain document be treated as confidential and, in these cases, those documents would be sealed and not available to the public.

Documents filed with the TCC and all evidence received by the Court are generally public records open to inspection by the public, unless on motion, the Court issues a confidentiality order pursuant to 16.1 of the Tax Court of Canada Rules (General Procedure).

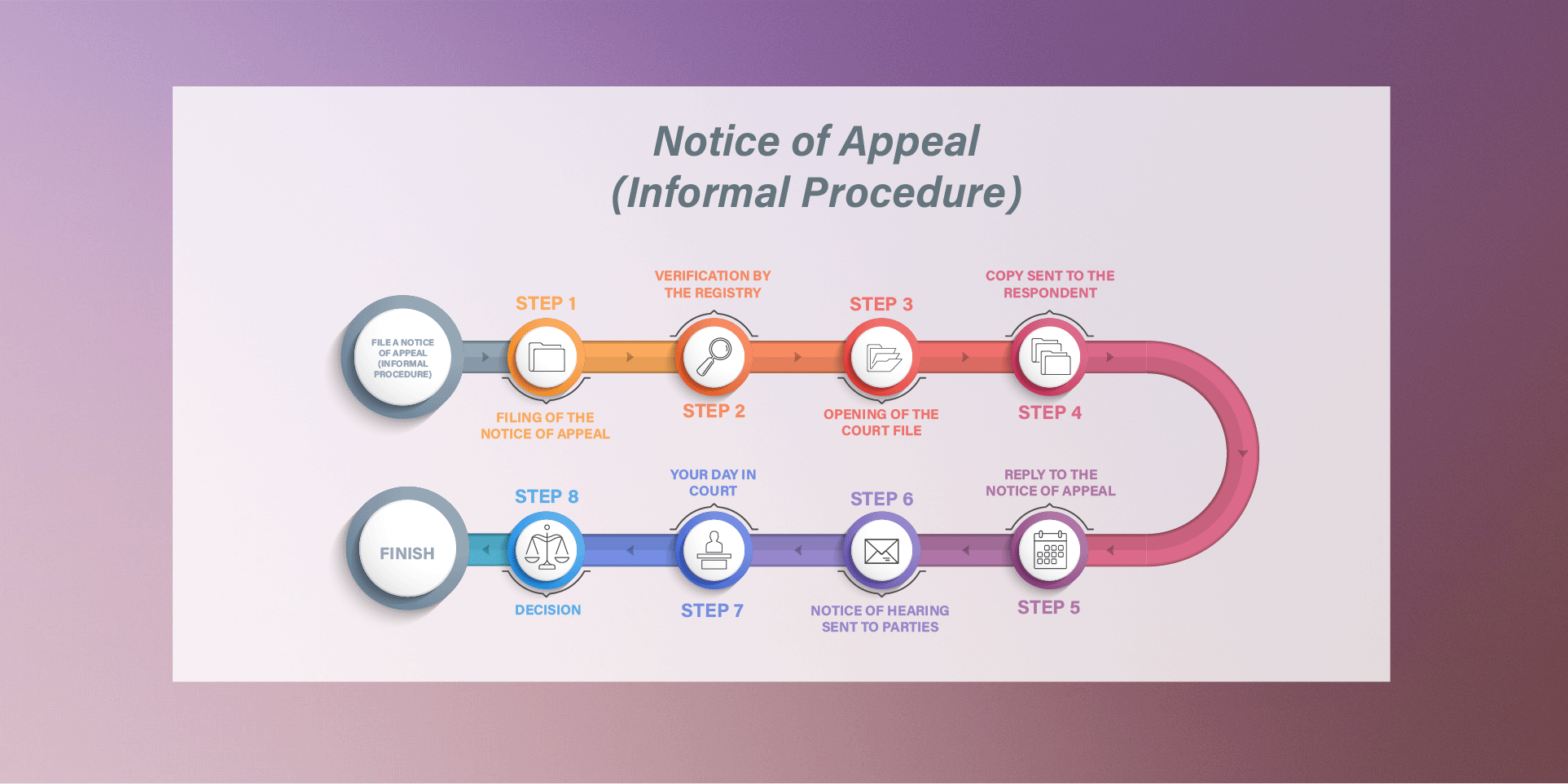

Notice to Appeal (Informal Procedure)

An overview of the Notice of Appeal (Informal Procedure) process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Notice of Appeal

- Step 2: Verification by the Registry

- Step 3: Opening of the court file

- Step 4: Copy sent to the Respondent

- Step 5: Reply to the Notice of Appeal

- Step 6: Notice of Hearing sent to parties

- Step 7: Your Day in Court

- Step 8: Decision

One last circle indicates ‘finish’.

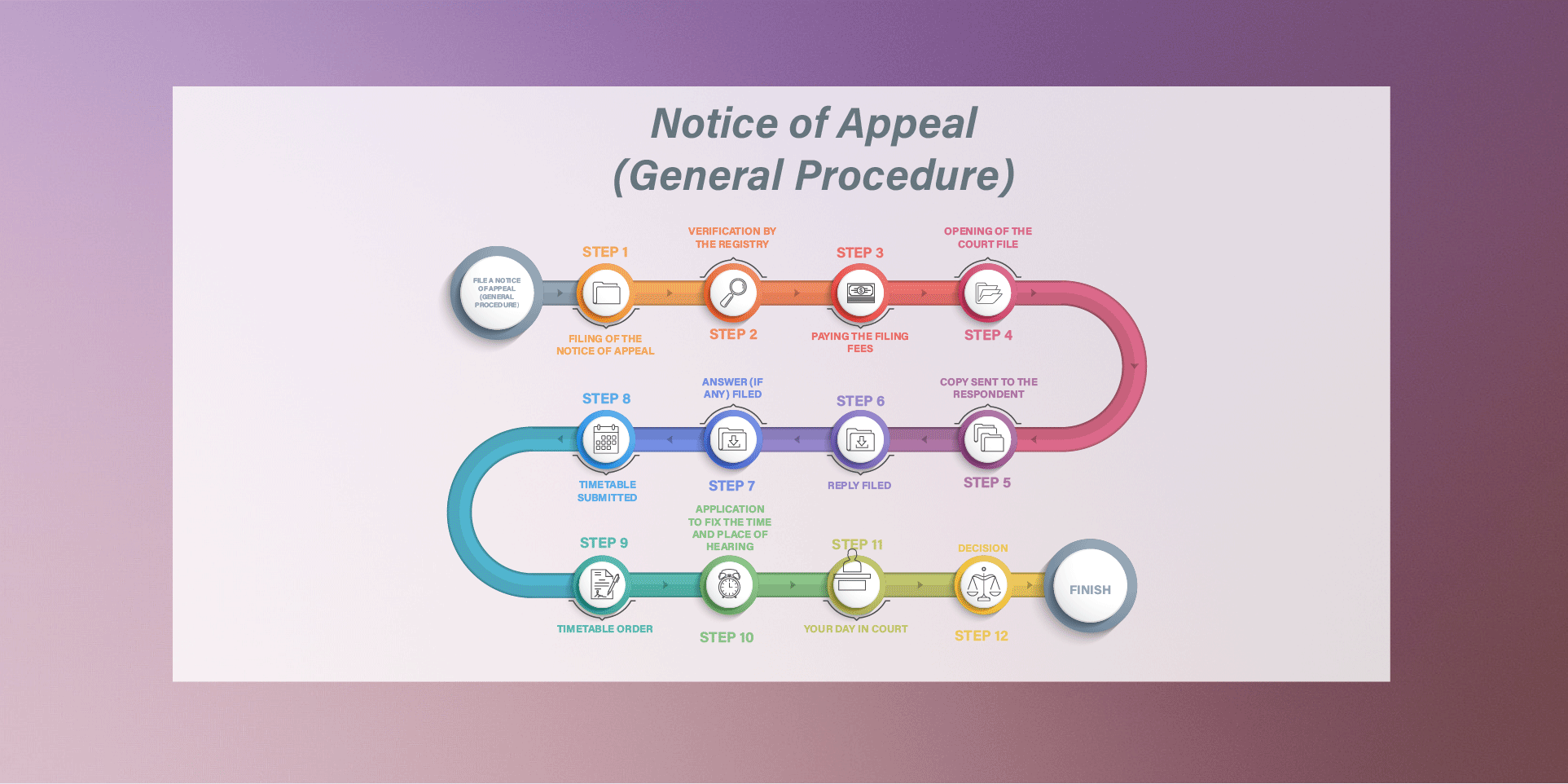

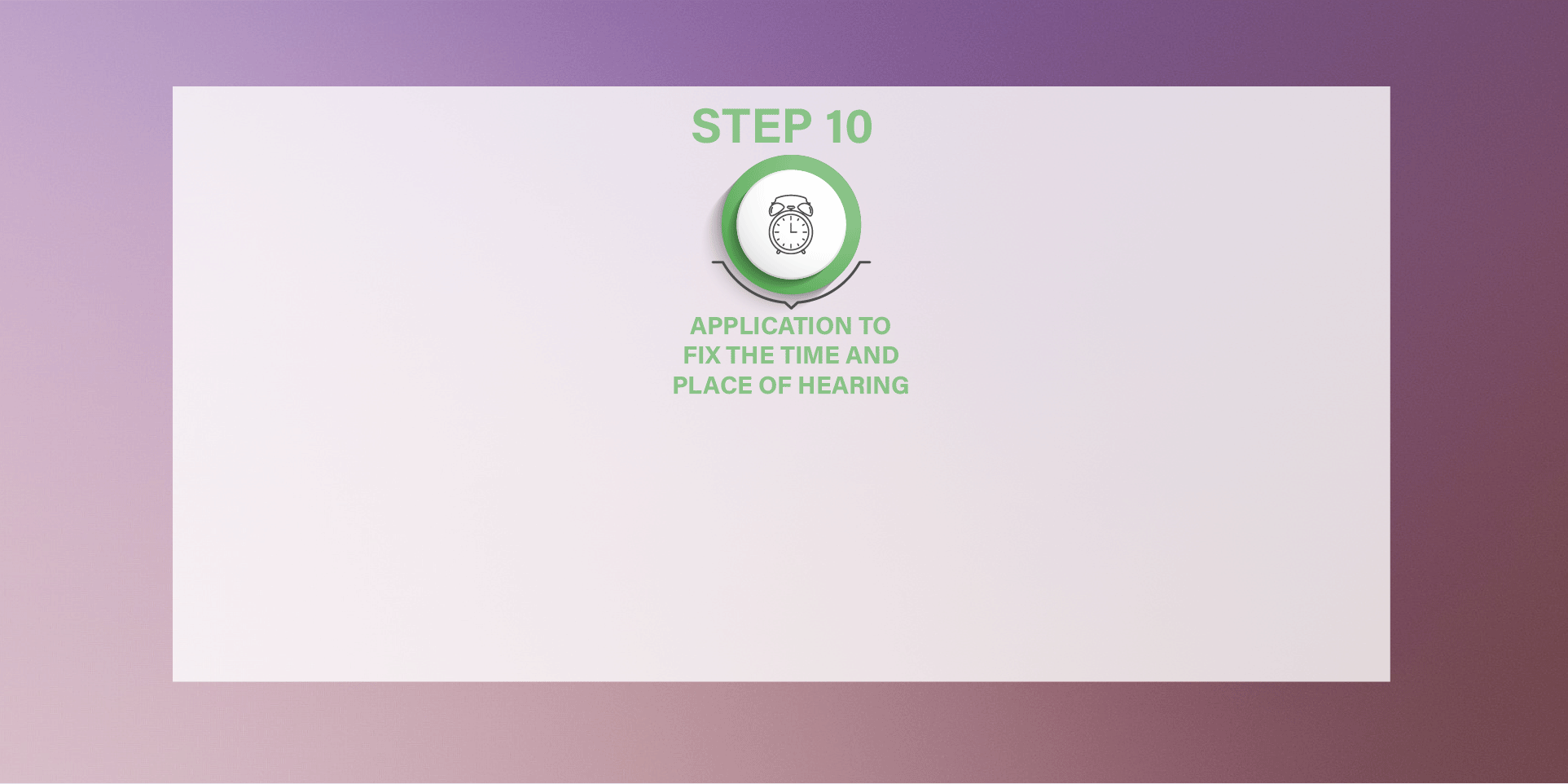

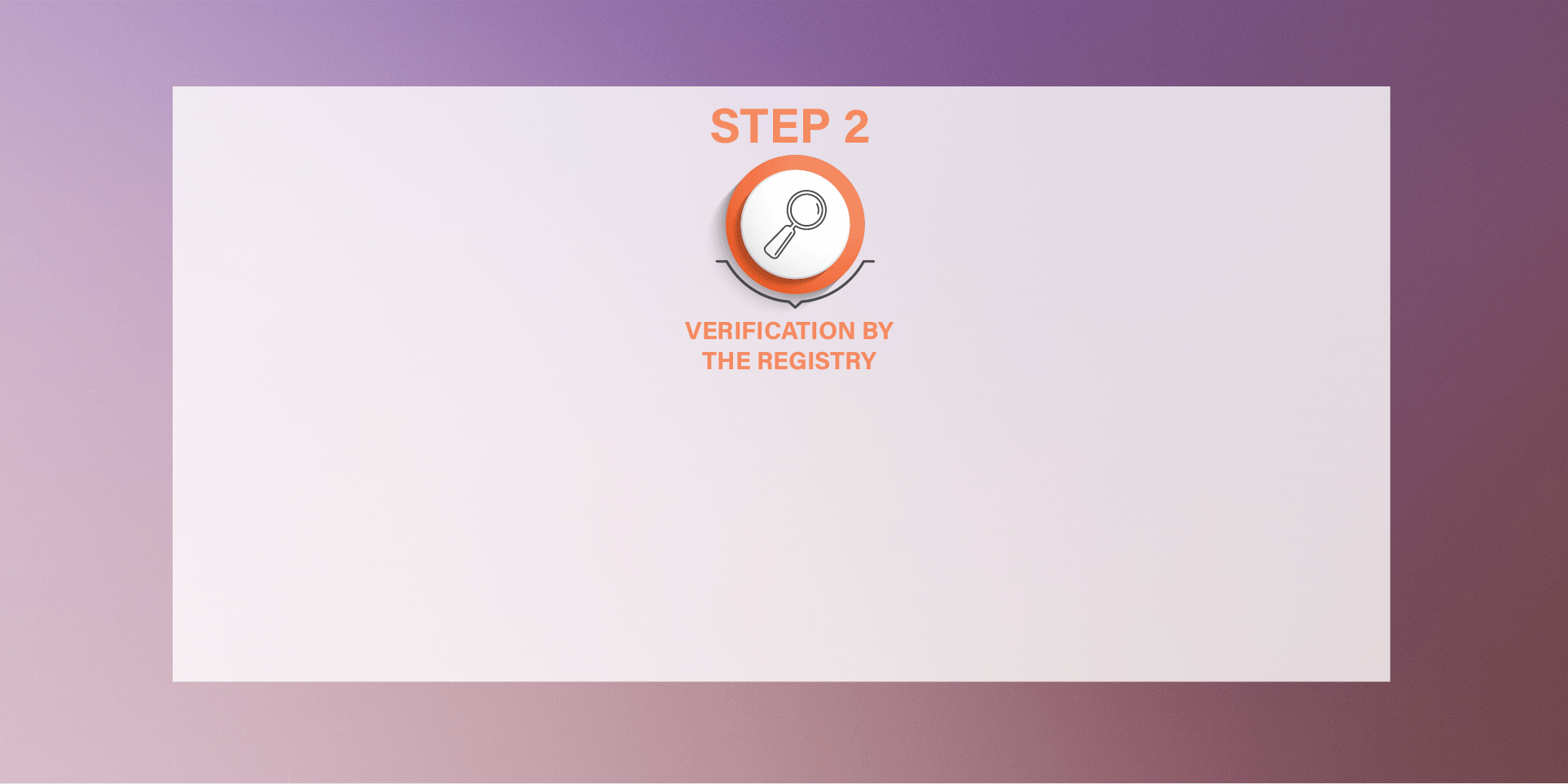

Notice to Appeal (General Procedure)

An overview of the Notice of Appeal (General Procedure) process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Notice of Appeal

- Step 2: Verification by the Registry

- Step 3: Paying the filing fees

- Step 4: Opening of the court file

- Step 5: Copy sent to the Respondent

- Step 6: Reply filed

- Step 7: Answer (if any) filed

- Step 8: Timetable submitted

- Step 9: Timetable order

- Step 10: Application to fix the time and place of hearing

- Step 11: Your Day in Court

- Step 12: Decision

One last circle indicates ‘finish’.

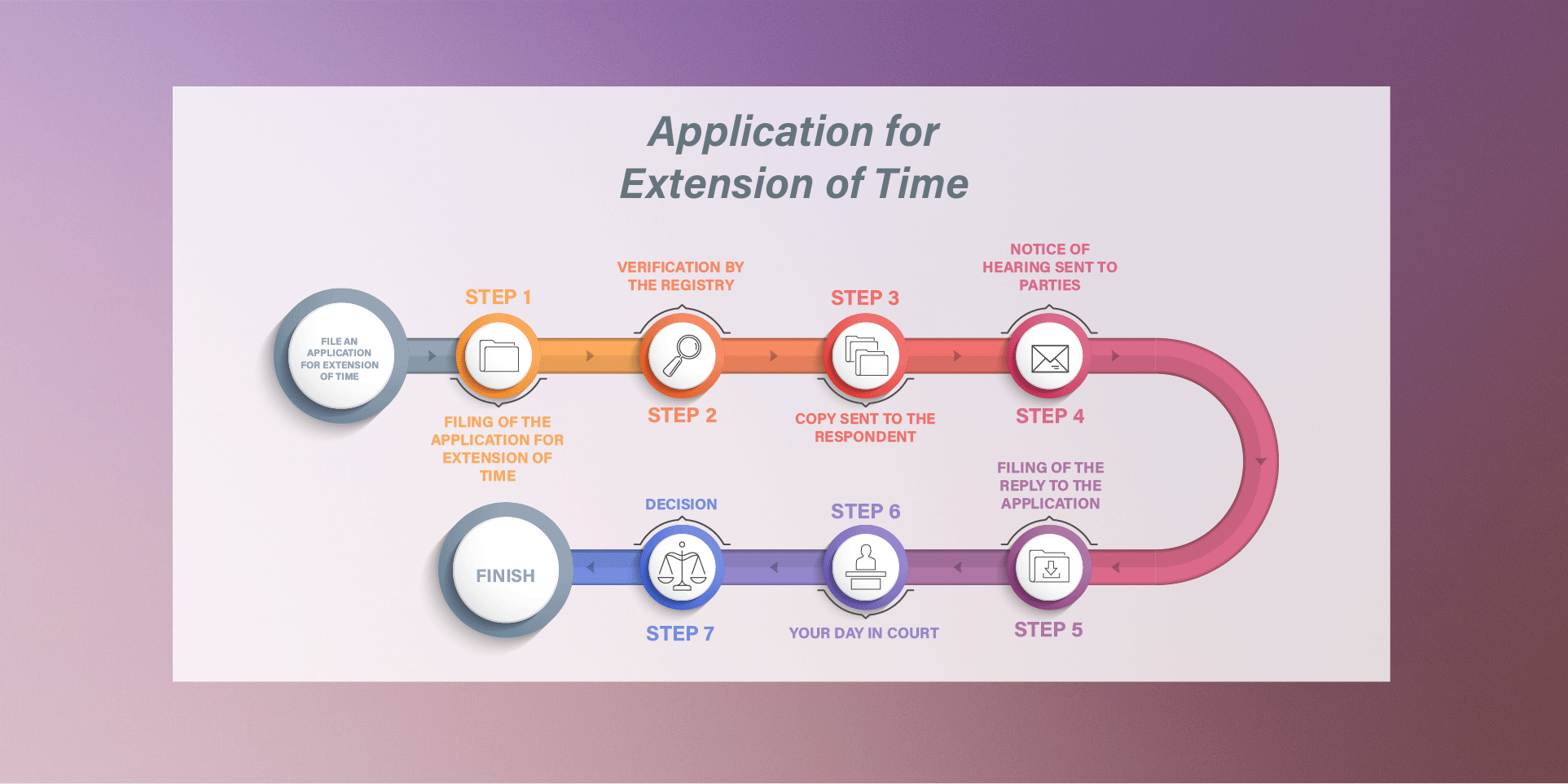

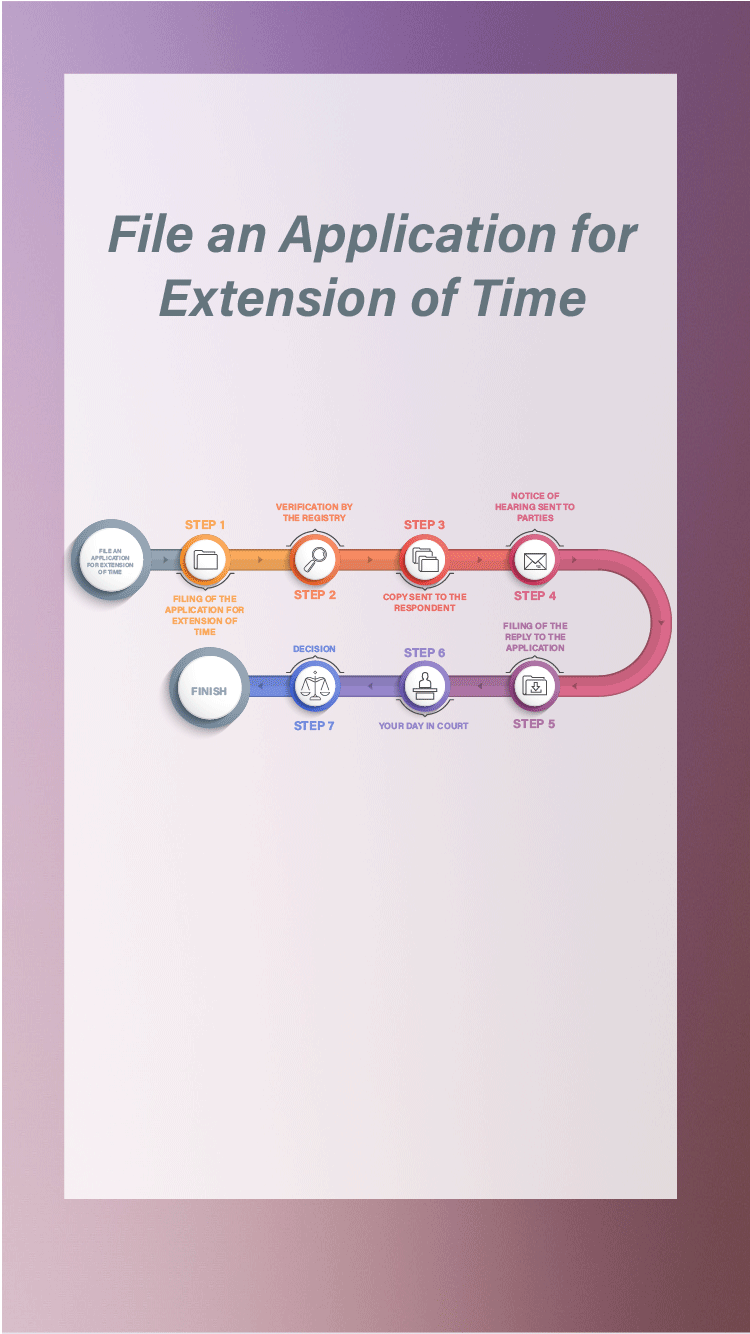

Application for Extension of Time

An overview of the Application for extension of time process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Application for extension of time

- Step 2: Verification by the Registry

- Step 3: Copy sent to the Respondent

- Step 4: Notice of Hearing sent to parties

- Step 5: Filing of the reply to the application

- Step 6: Your Day in Court

- Step 7: Decision

One last circle indicates ‘finish’.

Informal Procedure: The Court will usually schedule a hearing within 180 days after the last day on which the Reply to your Notice of Appeal must be filed. A Notice of Hearing will be sent to you or your representative by registered mail and will indicate the date, time and location of your hearing. The Notice of Hearing will be mailed at least 30 days before the date of your hearing. Please note that if it would be impracticable to fix within that period or if exceptional circumstances occur, your appeal may be fixed after the usual 180 days.

General Procedure: Every file is different. Once an appellant has filed an answer to the reply or the time for doing so has expired, the parties may submit a timetable of dates for the next procedural steps. The Registry will contact the parties and ask them to provide a timetable if they haven’t already done it of their own accord. The Court will issue an order setting dates for the completion of steps in the appeal. Orders setting dates are generally issued from dates submitted by the parties. Parties should carefully consider the dates they submit to the Court for litigation steps. The Court expects that parties will meet self-imposed ordered deadlines. Please refer to Practice Note 14 for more details. These steps are usually the service of lists of documents between parties, the conduct of examinations of discovery, satisfaction of undertakings and communication with the Court.

The communication with the court is normally an application to schedule a hearing date. The application may be a joint application by both parties or a unilateral application by only one of the parties. Once the application is received, the Court will proceed to schedule the appeal for hearing.

Your appeal will be heard at the hearing location closest to you or your representative’s address. The address of the hearing location will be indicated on the Notice of Hearing. You can see all Tax Court of Canada hearing locations on the Find Us map tool. You may also submit a written request to have your hearing held in another location where the Court sits.

Any judge of the Tax Court may hear your appeal. The identity of the judge hearing your appeal will not be divulged before the day of your hearing. An appeal filed in the French language, or for which a part or the entire hearing will proceed in French, will be heard by a bilingual judge.

If you have filed for bankruptcy after you have started an appeal process with the TCC, you must advise the Court, in writing, and provide the name and address of the trustee. The Registry will then request the trustee’s intention in regards to the continuance of the appeal.

The Tax Court of Canada is a bilingual court and provides services in both English and French. Documents can be filed in either official language in the Appellant’s language of choice and accordingly, the hearing will proceed in that language.

Should an Appellant wish to discontinue their appeal with the Tax Court of Canada they, or their representative, must send a Notice of Discontinuance to the Court.

A Notice of Discontinuance must include:

- the file number;

- the tax year(s) or period of time being appealed

- the name of the Appellant;

- an indication that it is the wish of the Appellant to discontinue their case;

- The signature, phone number, and address of the Appellant and their representative (if any)

You may request a copy by using the Request a Document form on our website. Note that fees will be charged if you request paper copies of the document.

In the case of death of a party, you must advise the Court in writing of such, provide a copy of the death certificate, and the name and address of the administrator or the executor of the estate, as well as the administrator’s or the executor’s intentions to continue or withdraw the appeal.

In Informal Procedure cases, anyone can represent you including yourself, an accountant, an agent or a lawyer.

In General Procedure cases, you (an individual) may represent yourself or be represented by a lawyer. Please see Section 17.1 of the Tax Court of Canada Act as well as Sections 19 and 65 of the Tax Court of Canada Rule (General Procedure).

In Informal Procedure cases, anyone can represent your company including yourself, an accountant, an agent, or a lawyer. For an appeal under the General Procedure a company must be represented by a lawyer.

In Informal Procedure cases, yes, you can represent a friend or family member in court.

In General Procedure cases, no, you cannot represent a friend or family member in court.

Parties in an appeal may be self-represented in court unless the Appellant is a corporation who has filed an appeal under the General Procedure. Corporations under this procedure are required to be represented by a lawyer.

Under the Informal Procedure, you can send a letter to the Registry with the new representative’s name and contact information. No specific form is required.

Under the General Procedure, you may change the counsel of record by serving on the counsel and every other party and filing, with proof of service, a notice giving the name, address for service and telephone number of the new counsel. Please see Section 32(1) of the Tax Court of Canada Rules (General Procedure).

The Department of Justice Canada represents the Canada Revenue Agency and by extension the following Respondents:

- For Income Tax and GST appeals – His Majesty the King;

- For EI/CPP appeals – The Minister of National Revenue;

- For OAS appeals – The Minister of Employment and Social Development

In Quebec, the Respondent in GST appeals is represented by Larivière Meunier.

It is always advisable to attempt to resolve a dispute without going to court. Both parties are encouraged to communicate with each other throughout the process to see if they can reach an agreement without going to court. If you are interested in settling your case, you should contact counsel for the Respondent to explore the possibility of settlement. The name of the counsel for the Respondent is usually found on the Reply to the Notice of Appeal.

Requests for a Settlement Conference are to be made in writing at any time; however, Settlement Conferences will not be scheduled unless parties have confirmed that a written Offer of Settlement has been made and that a written Reply has been provided. See Practice Note No. 21.

Preparing for your day in court is crucial. It starts well before the actual hearing day. We have prepared an entire section on our website detailing what to do before your day in court. We invite you to attend, if possible, another hearing prior to your scheduled hearing. It is recommended that you bring your Notice of Appeal and the Reply to the Notice of Appeal with you to the hearing. You will also need to bring five (5) copies of all documents you intend to submit to the Court at the hearing as you will need to provide copies to all parties, the Judge and the Court Registrar. We recommend that you view our video about coming to court as it may be helpful to you.

If you are not available for the date assigned for your hearing, send a letter requesting an adjournment as soon as possible to the Hearings Coordinator explaining in detail why you are not available. Please provide any documents to support your request, such as an itinerary for travel that was arranged before receiving your Notice of Hearing or medical certificate in case of illness. The Registry will seek the position of the other party/parties and submit both your request and the position of the other party/parties, to the Court for consideration. The Registry will then advise you of the Court’s decision.

If there is an emergency or you happen to fall ill on the day of your hearing, you should contact the Hearings Coordinator or the Registry immediately to inform them of your situation so the Judge presiding over your hearing can be informed as soon as possible. The Judge will make a decision as to how the case will proceed. The name of the Hearings Coordinator can be found on your Notice of Hearing.

There are no fees automatically associated with the adjournment of the hearing. However, if an adjournment is requested at the beginning of the hearing the Judge may award costs to the opposing party. Similarly, if this is a second or third adjournment request, or if the request for adjournment is made only days before the hearing, the court may charge costs if it grants the adjournment.

If you have moved during the course of your appeal, you must advise the Registry of your new address in writing and inform if you would like the hearing location to also be changed. If the appeal is scheduled, you must also request an adjournment of the hearing.

The Registry is unable to provide a complete response to this question as it may be considered legal advice. We encourage you to seek legal advice in order to have this question answered. Some information on where to find legal help can be found on our "Finding Legal Help" page.

If you intend to call witnesses for the hearing, it is suggested that you contact the Registry of the Court in writing in advance to obtain blank subpoenas, especially if expert witnesses like doctors or accountants are required. You are responsible to fill out the subpoena. Once completed, it must be personally served on the witness together with witness fees. Witnesses are entitled to be paid by the party who requested their attendance, up to $75 per day plus reasonable transportation and living expenses. Expert witness costs cannot exceed $300 per day in Informal Procedures and $350 per day in General Procedures. Please note that you will require proof of service of the subpoena if your witnesses fail to appear.

You must advise the Registry, in writing, as soon as possible by specifying the language for which this service is required. The Registry, once notified, will make the arrangements. Closed captioning or sign language interpretation services will be provided to a person who is deaf or hard-of-hearing and is scheduled to appear at a proceeding as a party or as a witness. A person requiring these services must submit a written request to the Registrar no later than two weeks prior to the hearing. Practice Note 15 details this procedure.

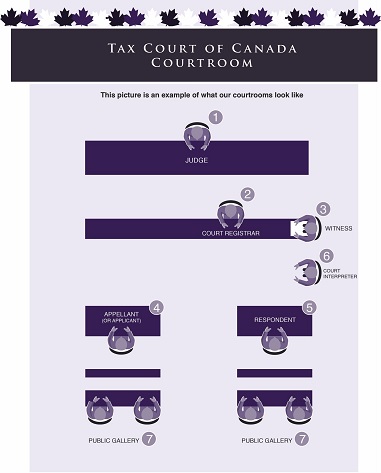

Your hearing will involve several participants, including:

- the judge, who controls the proceedings during the hearing;

- the court registrar, who will record the proceedings, administer oaths and record exhibits. You may purchase a copy of the transcript of the proceedings from the reporting firm. However, transcripts of oral reasons for judgments must first be requested by the Tax Court of Canada and will then be available to the parties if so requested;

- witnesses, if any;

- yourself and your lawyer or agent, if any;

- counsel for the respondent, who is a lawyer representing the other party in your appeal and;

- a court interpreter, if one is requested and;

- members of the public who are permitted to attend most hearings.

Here is an example of what the courtroom looks like.

Tax Court of Canada Courtroom appears on the top and centre of the image. Beneath that, we can read the following sentence: 'This picture is an example of what our courtrooms look like'.

Directly below that sentence, we have a rectangular table and an individual is sitting in the centre. The number ‘1’ appears next to that individual. The word 'judge' appears under that individual.

A second rectangular table is below the one with the judge. This one also has an individual sitting, slightly to the right of the judge. The number '2' appears next to this individual. The word 'Court Registrar' appears under that individual.

On the same table as the court registrar, to the right, there is a third individual sitting, facing the court registrar. The number '3' appears next to this individual. The word 'Witness' appears under that individual.

Standing next to the witness is another individual, identified with the number ‘6’. The word ‘Court interpreter’ appears under that individual.

On the bottom right side of the image, below the court interpreter, is a third table. An individual is sitting, facing the judge. The individual is identified as the Respondent and the number ‘5’ appears next to the individual.

On the bottom left side of the image is a fourth table. An individual is sitting, facing the judge. The individual is identified as the 'Appellant (or applicant)' and the number '4' appears next to the individual.

Finally, on the bottom of the image there are four individuals sitting (2 on each side) and facing the judge. They are all identified with the number '7' and the words 'public gallery'.

If you have not received a letter informing you of the name of the Respondent’s counsel, please contact the Registry.

Documents that you intend to rely on during the hearing should be given to the Respondent. Exchange of documents and communication between the parties prior to the hearing day is encouraged as it could help in resolving the appeal without the need of going to court.

It is recommended that you bring your Notice of Appeal and the Reply to the Notice of Appeal with you to the hearing. You will also need five (5) copies of all documents you intend to submit to the Court at the hearing. We encourage you to read our section regarding Your Day in Court and view our video.

Please arrive at least 30 minutes prior to the time scheduled for the commencement of your hearing.

Business attire is recommended for your hearing. Food, drinks, coats, hats, chewing gum, electronics (such as cellular phones, laptops, cameras and recorders) are not permitted in the courtroom except with leave of the court. Please note that the Tax Court of Canada's courtrooms are a scent-free environment.

Here is an example of what the courtroom looks like. Note that every location might have slight variations. You may also see our video about Your Day in Court to give you an idea of what the courtroom looks like.

Tax Court of Canada Courtroom appears on the top and centre of the image. Beneath that, we can read the following sentence: 'This picture is an example of what our courtrooms look like'.

Directly below that sentence, we have a rectangular table and an individual is sitting in the centre. The number ‘1’ appears next to that individual. The word 'judge' appears under that individual.

A second rectangular table is below the one with the judge. This one also has an individual sitting, slightly to the right of the judge. The number '2' appears next to this individual. The word 'Court Registrar' appears under that individual.

On the same table as the court registrar, to the right, there is a third individual sitting, facing the court registrar. The number '3' appears next to this individual. The word 'Witness' appears under that individual.

Standing next to the witness is another individual, identified with the number ‘6’. The word ‘Court interpreter’ appears under that individual.

On the bottom right side of the image, below the court interpreter, is a third table. An individual is sitting, facing the judge. The individual is identified as the Respondent and the number ‘5’ appears next to the individual.

On the bottom left side of the image is a fourth table. An individual is sitting, facing the judge. The individual is identified as the 'Appellant (or applicant)' and the number '4' appears next to the individual.

Finally, on the bottom of the image there are four individuals sitting (2 on each side) and facing the judge. They are all identified with the number '7' and the words 'public gallery'.

Although you may have a representative, you are still required to appear for your scheduled hearing day, as you will be taking the stand as a witness to your case.

Under the Informal Procedure, the judge may render a decision from the bench on the same day or reserve his or her decision. In the latter case, the court shall, other than in exceptional circumstances, render judgment not later than ninety days after the day on which the hearing is concluded. The Court will give reasons for its judgment orally or in writing.

Under General Procedure, there is no time limit for a decision to be rendered.

If you are not satisfied with a decision of the Tax Court of Canada and you decide to appeal the decision of the Tax Court, you may do so according to this table. Please contact the Registry of the Federal Court of Appeal for further information.

In the event the Appellant does not appear in Court for their informal procedure hearing, the Respondent may make a request to the presiding Judge that the appeal be dismissed for failure to appear. The Judge shall then order that the appeal be dismissed, unless he or she is of the opinion that circumstances justify that the appeal be set down for hearing at a later date. Please see section 18.21 of the Tax Court of Canada Act.

If at a general procedure hearing either party fails to appear, the Court may allow the appeal, dismiss the appeal or give such other direction as is just. Please see Rule 140 of the Tax Court of Canada Rules (General Procedure).

You may obtain a copy of the full transcript of your hearing by contacting reporting company directly. Reporting companies are determined based on the province where the proceeding was heard. You may refer to this chart for a list of Reporting companies currently used by the Tax Court of Canada. When requesting a transcript, be prepared to provide the company with the file number and hearing date. If you require any of this information, feel free to contact the Registry.

Following a hearing, parties can request a copy of a CD, or a recording of their hearing. In order to obtain this, one must be a party to a file. A request should be submitted to the Registry in writing, detailing the appeal number and the date of the hearing. An Undertakings form must also be signed and sent along with the written request. Once the request with the signed Form is received, a CD will be mailed. Please note at this time audio cannot be sent electronically.