The first step is to send your Notice of Appeal to the Court. You may do so electronically, in-person, by mail or by fax. The Notice of Appeal may be in the form set out in Schedule 4 , but a letter is also acceptable as long as it sets out, in general terms, the reasons for the appeal and the relevant facts such as the date of the assessment or assessments, the taxation years or GST periods at issue. You must also include your address for service and you are encouraged to provide your email and phone number.

Get Started

Representing Myself at the Tax Court of Canada

This section strives to give you information and tools to help you start your appeal or application, prepare for your hearing and understand what is expected of you. In no way does this section constitute legal advice or should be taken to mean that legal advice is not necessary. We encourage you to seek legal advice first. Some information on where to find a lawyer can be found here.

The term ‘Self-Represented Litigant’ describes people who go to court without a lawyer and represent themselves or through an agent. They are expected to be familiar with the Rules of the Court.

The term ‘Appellant’ is used to describe you when you appeal a decision whereas the term ‘Applicant’ is used to describe you when you apply to the Court for an extension of time.

The term ‘Respondent’ is used to describe His Majesty the King, represented by a Department of Justice Canada lawyer or by an agent from the Canada Revenue Agency appointed by the Attorney General of Canada.

For appeals which fall under the Informal Procedure, appellants may be self-represented, represented by legal counsel or have an agent (for example an accountant) act on their behalf. However, for those appeals which have been instituted under the General Procedure, Rule 30 of the Tax Court Rules (General Procedure) stipulates:

- ...a party to a proceeding who is an individual may act in person or be represented by counsel.

- Where a party to a proceeding is not an individual, that party shall be represented by counsel except with leave of the Court and on any conditions that it may determine.

- Unless the Court orders otherwise, a person who is the representative of a party under a legal disability in a proceeding shall be represented by counsel, except where that person is also counsel acting in such a capacity.

In all cases, it is recommended that you seek legal counsel/advice prior to commencing an appeal in the Tax Court as Registry personnel are not permitted to give you any legal advice. Please note that until your case is heard by a Judge, your contact with the Court will only be with staff of the Registry of the Tax Court. Therefore, it is important for you to understand what Registry staff can and cannot do to assist you in preparing your appeal.

The Registry’s role

What is the Registry? The Registry plays a central role in the Court’s operations. It is responsible for processing, recording and directing the flow of all documents filed by the parties. The Registry is the point of contact between the public and the judges.

Registry staff are able:

-

To inform you

- about what forms you may need to use and provide you with information to assist in filling out some of the forms.

- about interpreters and court reporters.

- about how the Court works and about the Tax Court practices and procedures.

-

To provide you

- with copies of applicable Court forms. These are also available on this website under “Acts, Rules & forms”. Please note that these forms are not forms with blanks to be filled out, but rather only indicate the standard format, wording and information that must appear in your document. It is intended that you will prepare your own documents and use the forms as a guide.

- an opportunity to make changes to the documents you have submitted in the event they do not comply with the Rules or are missing information.

- with information about motions, status hearings or other court hearings.

- Court lists and information on how to get a case set down for hearing.

- with information regarding the status of your appeal and the steps to be completed in order to have your appeal heard by the Court.

-

to check your forms and other court papers for completeness

- for example, ensure that documents are signed, comply with the Rules and that any cited attachments are present and signed by an authorized person within your province or territory).

-

to serve as a Commissioner of Oaths

- to swear/affirm any affidavits prepared by you, to be filed in the Tax Court of Canada.

Registry staff are not able:

-

to give you legal advice.

- It is strongly suggested that you seek legal advice before commencing a proceeding.

- to recommend the name of any lawyer to act on your behalf.

-

to tell you

- what words to use in your court documents and affidavits.

- whether you have included enough information in your court papers.

- what to say in court or how to make your legal arguments / submissions to a Judge.

- what the decision of the Court will be or give you any opinion about what it might be.

- to contact you to advise when your documents are due to be filed.

- to interpret orders made by a Judge.

- to change an order that has been made by a Judge.

- to allow you to communicate with a Judge at any time, other than at your Court hearing.

- to provide you the name of the judge hearing your appeal.

Having said all of this, please know that the Registry staff will do everything they can within their parameters to help you.

Informal and General Procedures

The Tax Court of Canada has exclusive original jurisdiction to hear and determine references and appeals to the Court on matters arising from 14 different Acts of Parliament. Most files that come to our Court relate to Income Tax or Goods and Services Tax (GST). Depending on your situation, the first document you need to file will either be called a Notice of Appeal or an Application for Extension of Time. To find out which procedure you can use, please use the tool in When Can I Come to the Tax Court of Canada section.

When it comes to Notices of Appeal, two types of procedures are generally available to you: the Informal Procedure and the General Procedure.

Informal Procedure

The Informal Procedure is intended to minimize and simplify the legal steps involved in the appeal process. There are no filing fees associated with this type of procedure. The Tax Court of Canada Rules (Informal Procedure) apply to all informal procedure appeals in the TCC under the Income Tax Act and the Tax Court of Canada Rules of Procedure Respecting the Excise Tax Act (Informal Procedure) apply to all informal procedure appeals in the TCC under the Excise Tax Act.

For income tax appeals, the Informal Procedure is limited to cases in which the amount of federal tax and penalties in dispute for each taxation year, excluding interest, is $25,000 or less and to cases in which the amount of loss in question is $50,000 or less. For GST appeals, on the other hand, the Informal Procedure is limited to cases in which the the amount at issue is $50,000 or less.

If your amounts exceed these limits but you would rather proceed with the informal procedure, you may do so by stating in your Notice of Appeal that you agree to limit your appeal to $25,000 or $50,000, as the case may be.

General Procedure

The General Procedure is more formal in its procedures and legal steps. Filing fees are also associated with this type of procedure. There are three classes of filing fees:

Class A

- where the amount in issue is less than $50,000

- for appeals in which a loss has been determined, where the amount of loss in issue is less than $100,000

- the filing fee is $250

Class B

- where the amount in issue is $50,000 or more but less than $150,000

- for appeals in which a loss has been determined, where the amount of loss in issue is $100,000, or more but less than $300,000

- the filing fee is $400

Class C

- where the amount in issue is $150,000 or more

- for appeals in which a loss has been determined, where the amount of loss in issue is $300,000, or more

- the filing fee is $550

The General Procedure is governed by the Tax Court of Canada Rules (General Procedure). A copy of the TCC's rules may be required to help you follow the entire process. Please refer to section 17 of the Tax Court of Canada Act. A copy of the Act and the Rules may also be obtained from any Registry office of the TCC.

When appealing under the General Procedure, you may represent yourself or be represented by a lawyer. A corporation must be represented by a lawyer.

When Can I Come to the Tax Court of Canada

You may not appeal an assessment under the Income Tax Act or the Excise Tax Act before the Tax Court if you have not sent a ‘notice of objection’ to the Canada Revenue Agency (CRA). The review of your notice of objection by the CRA will result in a reassessment, a confirmation or a determination. If you do not agree with the CRA's answer to your notice of objection, you have 90 days from the date of the reassessment, confirmation or determination to appeal to the TCC.

You may also appeal to the TCC if the CRA does not respond to your notice of objection within 90 days in an income tax case or 180 days in a GST case.

Please use the tool below to find out if the Tax Court is the right place for you to come and if so, which document you can file.

Tell us your story.

My file relates to .

What Happens after Filing the First Document

Notice to Appeal (Informal Procedure)

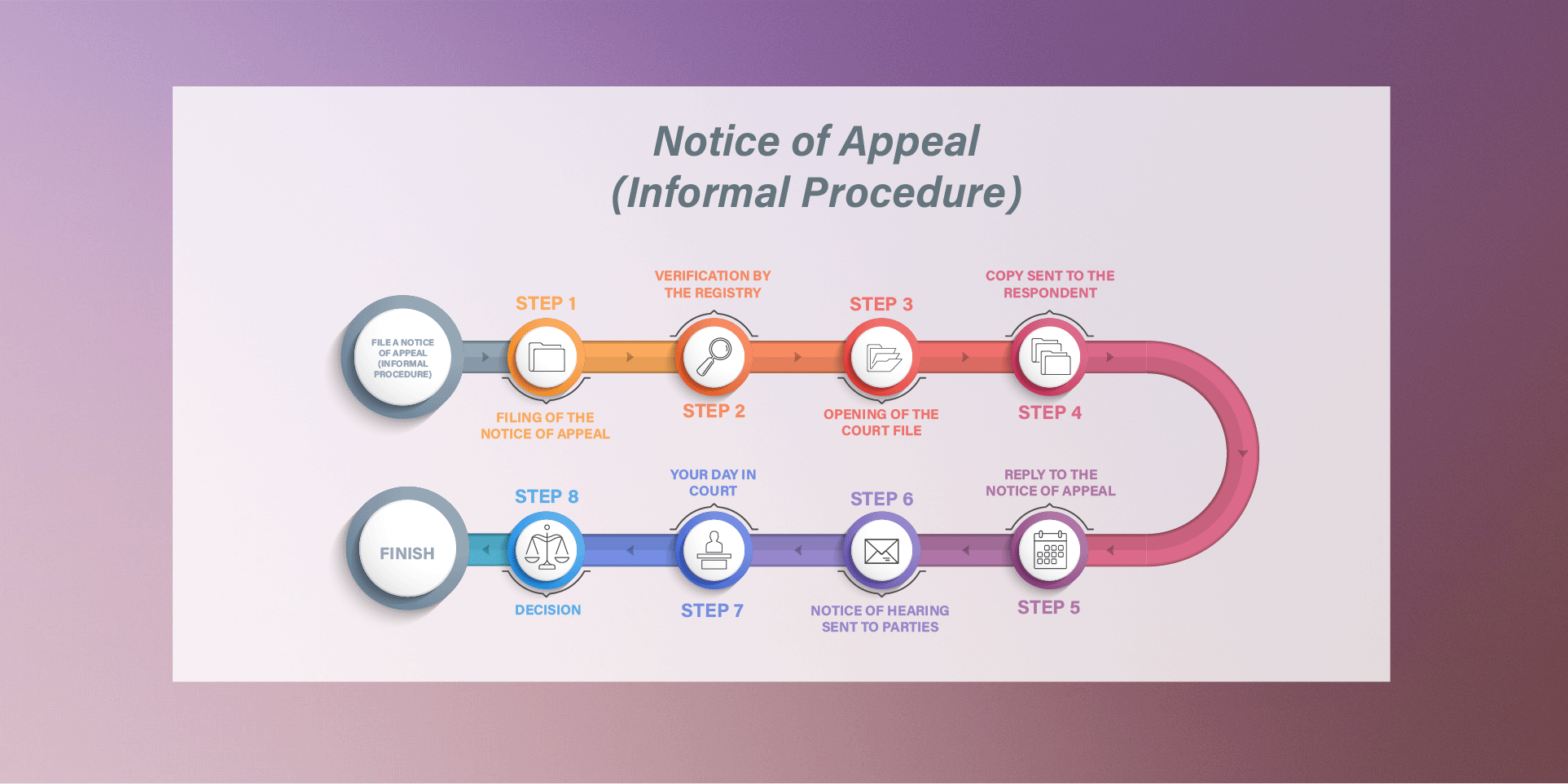

An overview of the Notice of Appeal (Informal Procedure) process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Notice of Appeal

- Step 2: Verification by the Registry

- Step 3: Opening of the court file

- Step 4: Copy sent to the Respondent

- Step 5: Reply to the Notice of Appeal

- Step 6: Notice of Hearing sent to parties

- Step 7: Your Day in Court

- Step 8: Decision

One last circle indicates ‘finish’.

Notice to Appeal (General Procedure)

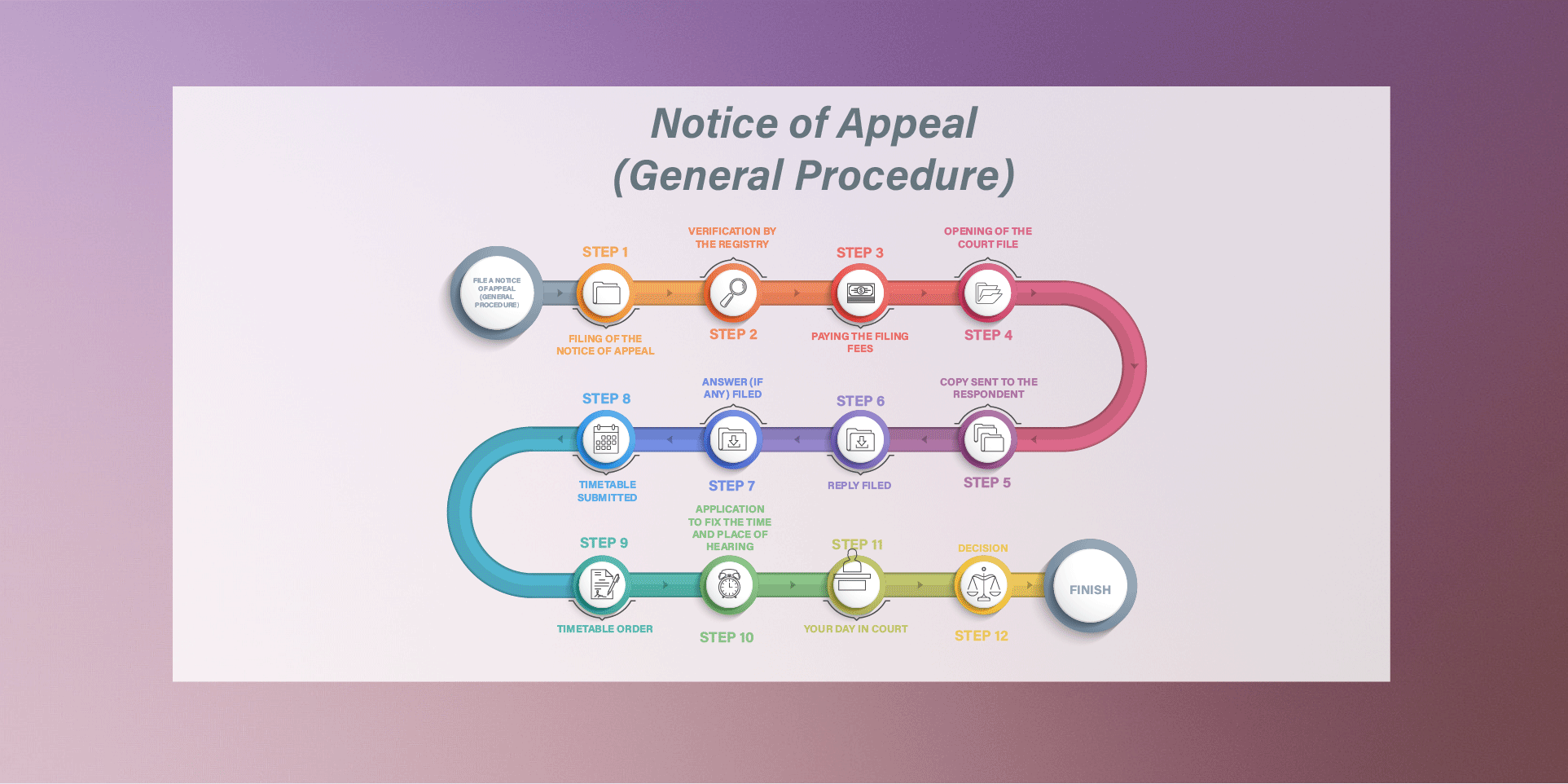

An overview of the Notice of Appeal (General Procedure) process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Notice of Appeal

- Step 2: Verification by the Registry

- Step 3: Paying the filing fees

- Step 4: Opening of the court file

- Step 5: Copy sent to the Respondent

- Step 6: Reply filed

- Step 7: Answer (if any) filed

- Step 8: Timetable submitted

- Step 9: Timetable order

- Step 10: Application to fix the time and place of hearing

- Step 11: Your Day in Court

- Step 12: Decision

One last circle indicates ‘finish’.

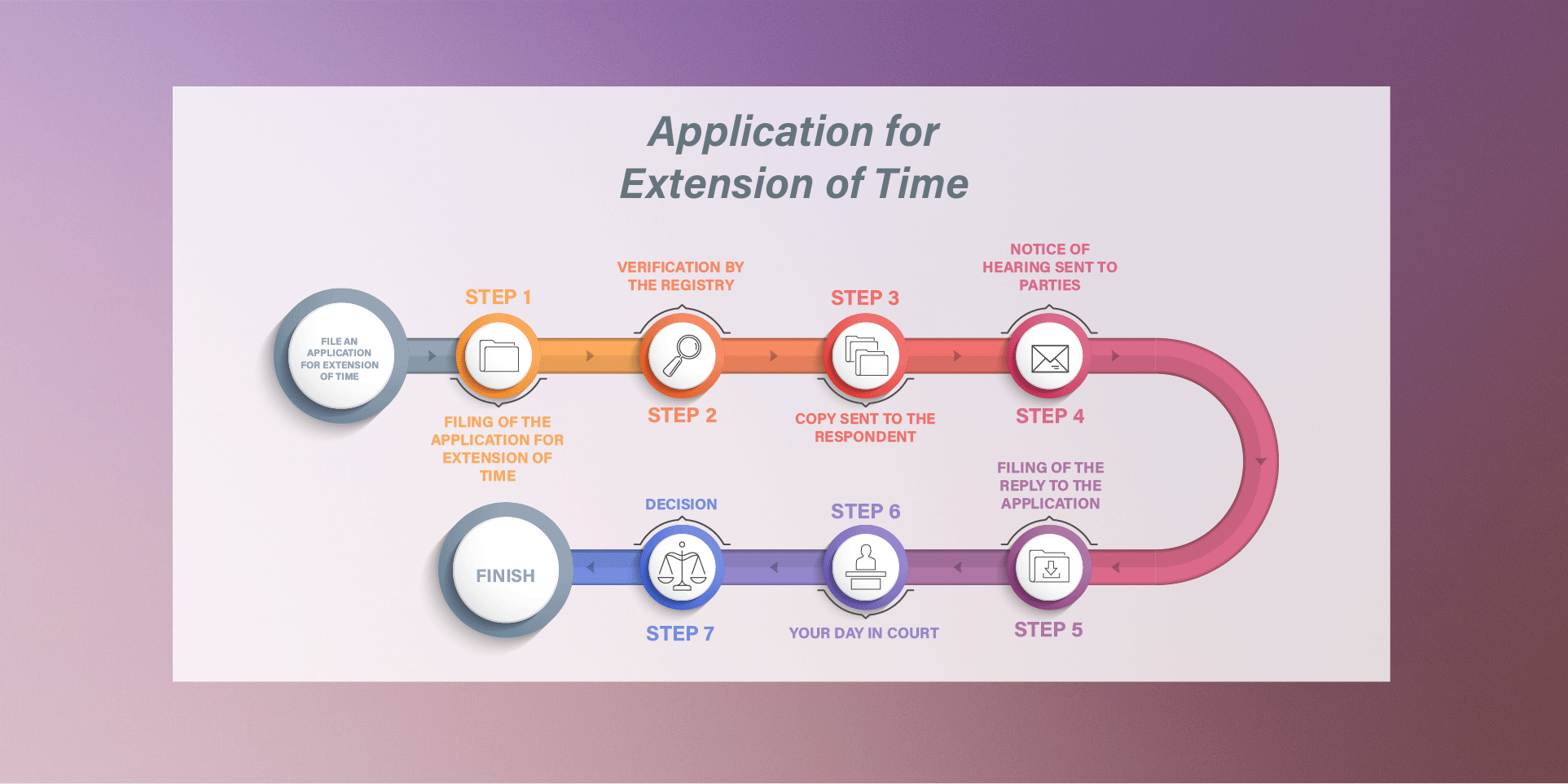

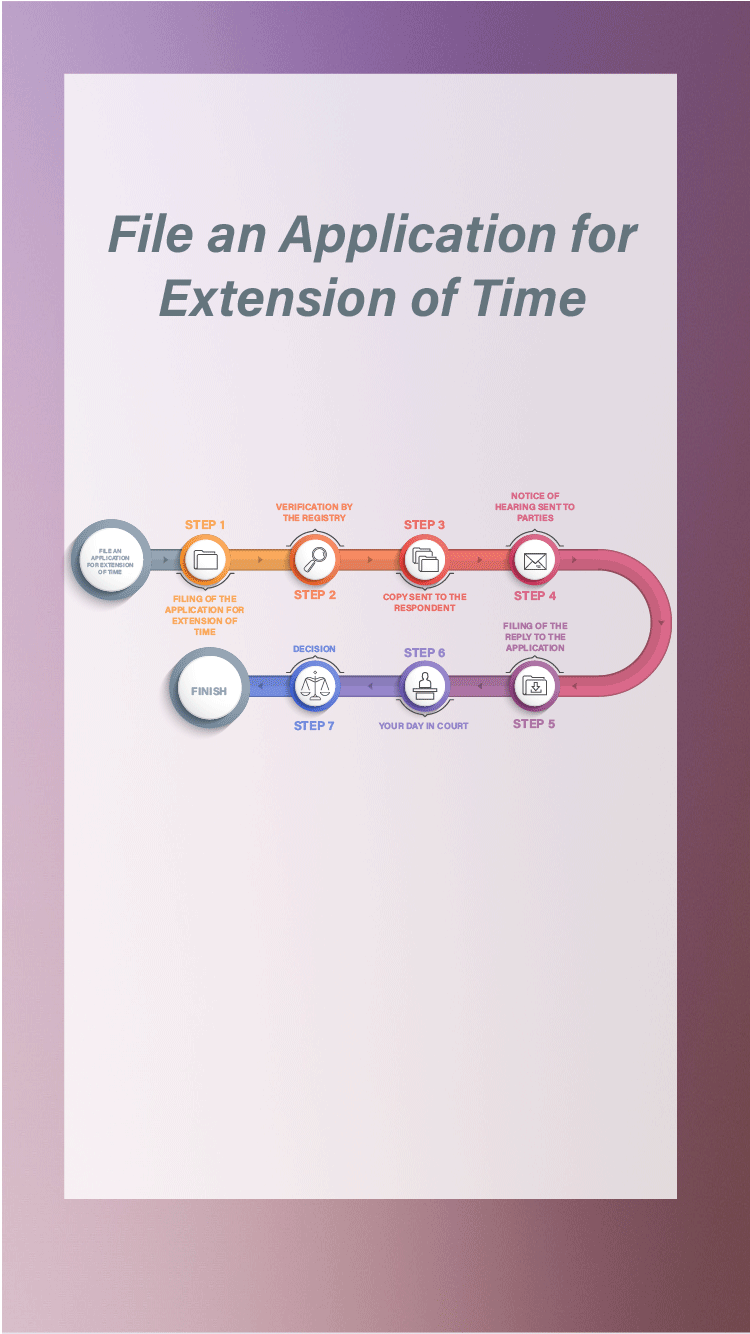

Application for Extension of Time

An overview of the Application for extension of time process is shown in an image. Circles indicate each of the following steps:

- Step 1: Filing of the Application for extension of time

- Step 2: Verification by the Registry

- Step 3: Copy sent to the Respondent

- Step 4: Notice of Hearing sent to parties

- Step 5: Filing of the reply to the application

- Step 6: Your Day in Court

- Step 7: Decision

One last circle indicates ‘finish’.

How to Calculate Deadlines

Knowing how to calculate deadlines for serving and filing documents is important in order to do these steps within the prescribed timelines.

You need to keep in mind Court office hours, federal and provincial holidays and the Court’s winter holiday period. There are differences depending on the chosen filing method (electronic, in person, by mail or by fax) and the court procedure (informal or general).

Statutory deadlines to file an appeal

Appeals under the Income Tax Act and under the Excise Tax Act

If you received a notice of reassessment, a notice of confirmation or a notice of determination, you can appeal this assessment or determination at the Court. You have 90 days to file a notice of appeal starting from the day following the date of the issuance of the notice.

Your notice of appeal must be received by the Registry of the Court on or before the last day of the 90-day period. If you are unable to act within this 90-day period, you can apply for an extension of time under certain circumstances.

Section 169 of the Income Tax Act

Section 302 of the Excise Tax Act

Appeals under the Employment Insurance Act and under the Canada Pension Plan Act

To appeal a decision of the Minister, you must file a notice of appeal at the Tax Court of Canada within 90 days after the date that the decision was mailed to you. If the mailing date is unknown, that 90-day period starts from the date indicated on the decision.

Tax Court of Canada Rules of Procedure respecting the Employment Insurance Act

Tax Court of Canada Rules of Procedure respecting the Canada Pension Plan

The filing date

The filing date is the date that a document is received by the Tax Court of Canada’s Registry.

If a document is filed electronically, the filing deadline for the day is midnight (12:00AM) according to the regional time of the office of the Court where you file the document.

If a document is filed in person, by mail or by fax, the daily filing deadline is before the Court’s Registry closes for the day. The registries are open from 8:30 a.m. to 4:30 p.m. Monday to Friday, except holidays (please see federal and provincial holidays below).

Calculating deadlines in days

When a document is to be served or filed within a time after, from of or before a specified day, the time does not include that day. It includes all other days, including weekends and federal and provincial holidays. The Court’s winter holiday period will be excluded for specific steps, please refer to the section below for more details.

The deadline ends on the last day of the set number of days. If counting backwards, count the day on which the period starts and count backwards until you reach the set number of days.

Winter holiday period

Except where a contrary intention appears:

Under the informal procedure, the period beginning on December 21 in any year and ending on January 7 of the next year shall be excluded when counting days only for the purpose of the following steps:

- The Minister filing a reply to the notice of appeal;

- The Tax Court of Canada fixing a date of hearing;

- The Tax Court of Canada rendering the decision.

Under the general procedure, the period beginning on December 21 in any year and ending on January 7 of the next year shall be excluded when calculating deadlines under the general procedure rules or a direction. This therefore excludes the deadlines for the filing of a notice of appeal or an application for extension of time, which are statutory deadlines.

Federal and provincial holidays

When a deadline to file a document or do something falls on Saturday or a federal holiday, the deadline is extended to the following day that is not Saturday or a federal holiday.

The federal statutory holidays are the following:

- Sundays;

- New Year's Day (if January 1 falls on Saturday or Sunday, the following Monday is a holiday for date computation purposes);

- Good Friday;

- Easter Monday;

- Victoria Day (Monday preceding May 25);

- Canada Day (if July 1 falls on Saturday or Sunday, the following Monday is a holiday for date computation purposes);

- Labour Day;

- National Day for Truth and Reconciliation;

- Thanksgiving Day;

- Remembrance Day (if November 11 falls on Saturday or Sunday, the following Monday is a holiday for computation purposes);

- Christmas Day.

The Registry is open during provincial holidays. However, the Registry may either have limited staff or be closed on the following provincial holidays. To avoid missing a deadline, please file the document the day of or before the following days:

- Saint-Jean-Baptiste Day (June 24th, for offices located in QC only);

- Civic Holiday (first Monday of August, for offices BC, AB, SK, MB, ON, NB, NS, PE, NL only);

- Boxing Day (December 26 for all offices).

Please note that the third Monday of February (Family Day) is a regular workday for the Tax Court of Canada.

Examples

On Monday, January 20, 2020 you received a notice of reassessment stating that you have unreported income. The notice of reassessment is dated Monday, January 13, 2020. The 90-day period to file your notice of appeal starts to run on Tuesday, January 14, 2020 (the day following the issuance of the notice by the Minister). You should count January 14th as the first day and stop on the 90th following day. Your notice of appeal should be received by the registry on or before Sunday, April 12, 2020. Since Sundays are federal statutory holidays, the deadline falls on the following day that is not a Saturday, Sunday or a federal statutory holiday. In this case, the deadline to file the notice of appeal would be Tuesday, April 14, 2020 because Monday, April 13, 2020 is also a federal holiday.

On Thursday, December 17, 2020, you receive a notice of confirmation dated Tuesday, December 15, 2020. You have 90 days to file a notice of appeal starting from the day following the date of the issuance of the notice of confirmation. For the purpose of computing these 90 days, you shall count all days, including the Court’s winter holiday period. You shall not consider the winter holiday period, since the document you are filing is a notice of appeal, the deadline for filing is a statutory deadline that is not enacted by the Court. You must file your notice of appeal on or before Monday, March 15, 2021.

You were served with the reply to the notice of appeal on Tuesday December 1, 2020. You have 30 days to serve and file an optional answer. You must count 30 days, excluding the period from December 21 to January 7. That will bring you to Monday, January 18, 2021.

You received a decision of the Minister stating that you are not eligible for employment insurance. The decision is dated December 1, 2020. You are not aware of the date that the decision was mailed to you. Starting December 1, 2020, count 90 days forward. Your notice of appeal must be received by the Court’s registry on or before March 1, 2021.

You filed your notice of appeal to the Court on November 27, 2020. The Court served it to the Minister on November 30, 2020. The Minister disposes of a 60-day period to file a reply (on or before January 29, 2021). However, since the winter holiday period from December 21 to January 7 shall be excluded from date computation in this situation, the 60-day period ends instead on Tuesday, February 16, 2021. The Minister will have until Tuesday, February 16, 2021 to file his reply.

Ways to Resolve my Appeal

It is always advisable to attempt to resolve a dispute without going to court. Both parties are encouraged to communicate with each other throughout the process to see if they can reach an agreement without going to court. We encourage parties to have settlement discussions as soon as possible after the pleadings are closed.

The Court can schedule a Settlement Conference on its own initiative or at the request of a party. Practice Note 21 states the following:

- Settlement conferences will not be scheduled unless parties to the litigation have confirmed that a written offer of settlement has been made and that a written reply has been provided.

- Both parties must be present at all times during the settlement conference.

- Parties to the settlement conference must ensure that a representative with full authority to settle the appeal is present at all times.

- The Court may award costs against a party where it deems the conduct of that party to have impeded on the efficient functioning of the settlement conference.

If the appeal proceeds to a court hearing, the appeal is resolved by having both parties appear in court to present their versions of the facts to a judge. It is important to note that you will have to explain why you disagree with the Minister’s decision and provide evidence to that effect.

The judge will then decide the appeal based on the evidence and arguments presented to the Court.

My Day in Court

Preparing for your day in court is crucial. It starts well before the actual hearing day.

As soon as you are notified of your court date, mark your calendar! If you are not available for the date assigned, send a letter to the Court as soon as possible explaining in detail why you are not available. This is called an adjournment request. A judge will review the request and make a decision. You may ask for the Respondent’s consent before sending your request. If you obtain their consent, attach it to your request. Please note that an adjournment request for medical reasons must be accompanied by a medical certificate. If you are unavailable because you had previously booked travel plans, your adjournment request must be accompanied by the travel booking confirmation.

If you intend to call witnesses for the hearing, it is suggested that you contact the Registry of the Court in writing in advance to obtain subpoenas, especially if expert witnesses like doctors or accountants are required. Should you need any further information, please don’t hesitate to Ask a Question to the Registry of the Court.

If you or any of your witnesses have special needs or require a translator or interpreter, contact the hearings coordinator identified in your notice of hearing, or the Registry of the Court immediately so that arrangements may be made in advance to accommodate your needs. There is no charge for these services. Practice Note 15 is specific to requests for closed captioning or sign language interpretation. Such requests are to be submitted no later than 2 weeks before the hearing.

You will need at least four (4) copies, in addition to your own, of any documents you intend to submit to the Court at the hearing. This will enable both the judge and counsel for the respondent to better follow the presentation of your evidence. If there are interveners in your appeal, you should bring copies for them as well.

You need to sort all your documents before the day of your hearing, in the order you wish to present them. The Court expects you to be prepared to proceed without delay on the day of your hearing.

Parties are encouraged to submit to the Court books of documents as well as books containing case law and statutes. These books are prepared to facilitate the trial process. The presentation of books of documents and case books is vital to the trial process and the Court encourages their production.

Where the contents of such books exceed 10 pages, their contents shall be indexed and their pages shall be numbered consecutively. Cases and documents shall be separated by tabs, each tab identified either numerically or alphabetically.

We encourage you to watch our video about Your Day in Court and invite you to attend, if possible, another hearing prior to your court appearance. This will help you become familiar with the Court's procedure and understand how a hearing is conducted. You may consult our calendar to see when a case will be heard near you.

You should arrive and be ready for your hearing 30 minutes prior to the time scheduled for commencement indicated on your notice of hearing or order. Your case may not be called first but your presence at the scheduled time is mandatory. Before the beginning of proceedings, locate the court registrar and notify them of your presence. The court registrar will provide instructions, including where to sit, where you will testify and other information. We encourage you to address any questions you may have to the court registrar before the sitting is opened. The court registrar cannot, however, answer any questions of a legal nature.

Your hearing will involve several participants, including:

- the judge, who controls the proceedings during the hearing;

- the court registrar, who will record the proceedings, administer oaths and record exhibits. You may purchase a copy of the transcript of the proceedings from the reporting firm. However, transcripts of oral reasons for judgments must first be requested by the Tax Court of Canada and will then be available to the parties if so requested;

- witnesses, if any;

- yourself and your lawyer or agent, if any;

- counsel for the respondent, who is a lawyer representing the other party in your appeal and;

- a court interpreter, if one is requested and;

- members of the public who are permitted to attend most hearings.

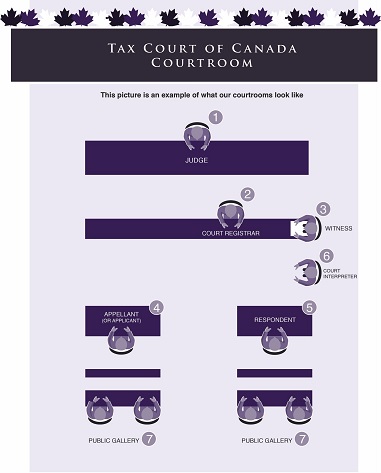

Here is an example of what the courtroom looks like.

Tax Court of Canada Courtroom appears on the top and centre of the image. Beneath that, we can read the following sentence: 'This picture is an example of what our courtrooms look like'.

Directly below that sentence, we have a rectangular table and an individual is sitting in the centre. The number ‘1’ appears next to that individual. The word 'judge' appears under that individual.

A second rectangular table is below the one with the judge. This one also has an individual sitting, slightly to the right of the judge. The number '2' appears next to this individual. The word 'Court Registrar' appears under that individual.

On the same table as the court registrar, to the right, there is a third individual sitting, facing the court registrar. The number '3' appears next to this individual. The word 'Witness' appears under that individual.

Standing next to the witness is another individual, identified with the number ‘6’. The word ‘Court interpreter’ appears under that individual.

On the bottom right side of the image, below the court interpreter, is a third table. An individual is sitting, facing the judge. The individual is identified as the Respondent and the number ‘5’ appears next to the individual.

On the bottom left side of the image is a fourth table. An individual is sitting, facing the judge. The individual is identified as the 'Appellant (or applicant)' and the number '4' appears next to the individual.

Finally, on the bottom of the image there are four individuals sitting (2 on each side) and facing the judge. They are all identified with the number '7' and the words 'public gallery'.

Normal business attire is recommended for court appearances.

Food, drinks, coats, hats, chewing gum, electronics (such as cellular phones, laptops, cameras and recorders) are not permitted in the courtroom except with leave of the court. When speaking to the judge or when he or she speaks to you, please stand and address the judge as "Your Honour". Always face the judge and speak loud and clear. The court registrar is addressed as "Mr./Ms. Registrar".

Guests are welcome. Our courtrooms are open to the public. However, only those who have a direct role in the hearing are permitted to sit at the table for counsel. Guests and members of the public are seated in the audience.

- When the proceedings begin, the court registrar enters the courtroom followed by the judge, at which point everyone rises.

- The court registrar declares the sitting open, asks everyone to be seated and announces the first case.

- In most instances, the appellant is asked to present his or her case first. You will be asked to enter the witness stand and to state your full name and address. You will also be asked to either take an oath or give a solemn affirmation; the choice is yours. At this point, the judge will usually expect you to present your case. This simply involves telling the judge the facts and the reasons for your appeal and providing documents or other evidence in support of your explanations. Either side may call witnesses to testify. Either party may also request that the judge exclude witnesses during the testimony of other witnesses, in order that a subsequent witness not hear testimony from the preceding witness. When submitting exhibits or other documents, show them to the other party first and then hand them to the court registrar. Both parties may object to the use of any of the documents that are submitted as exhibits. The judge will make a decision on the objection. The judge is neutral and independent and has no knowledge of your particular case beyond what has been set out in the pleadings (notice of appeal, reply and answer). That is why the judge may ask you additional questions for clarification.

- After you have presented your case and called your witnesses, counsel for the respondent will be permitted to ask questions to you and your witnesses. Once you are finished, counsel for the respondent will present their position in response to your case. You may ask questions to witnesses called by counsel for the respondent once they have finished questioning them.

- After all the documents and facts have been presented, you must present your position as to how the law should be applied to your appeal.

- Counsel for the respondent will then present their position as to why the appeal should be dismissed. You are entitled to respond to any new argument raised by the respondent.

- Once both parties have concluded their arguments, the judge may either take a recess, give his or her decision or reserve the decision. In the latter case he or she will give the decision at a later date. You will receive an official copy of the judgment by registered mail. Please note that if reasons for judgment are issued in writing in your appeal, they will be published on the Tax Court of Canada website and in other publications, as this is public information.

If you have incurred costs, you may ask the judge for costs and the judge may, at his or her discretion, award you costs pursuant to the TCC Rules. Should you be unsuccessful in your appeal, costs may be awarded against you.

You should also be knowledgeable of the fees paid to witnesses who have been served with a subpoena. See the Tax Court of Canada Rules applicable to your appeal.

The Court transcript is a written account of a hearing. Transcripts detail everything said at a hearing, and by whom. All Tax Court of Canada proceedings (including in-person hearings and conference calls) are recorded, and parties can request copies of these transcripts. Individuals who wish to request copies of transcripts must go through the reporting company that recorded the hearing. If you are interested in receiving the reasons for a final decision in a file, please refer to the section on "written/oral reasons for Judgement". Reporting companies are determined based on the province where the proceeding was heard. You may refer to the chart below for a list of Reporting companies currently used by the Tax Court of Canada. When requesting a transcript, be prepared to provide the company with the file number and hearing date. If you require any of this information, feel free to contact the Registry.

| Province | Reporting Company |

|---|---|

| Alberta | Royal Reporting Services Ltd. 1-800-667-6777 |

| British Columbia | Allwest Court Reporting 604-683-4774 |

| Manitoba | Royal Reporting Services Ltd. 1-800-667-6777 |

| New Brunswick | Atchison & Denman 1-800-250-9059 |

| Newfoundland and Labrador | Discoveries Unlimited 709-437-5028 |

| Northwest Territories | Royal Reporting Services Ltd. 1-800-667-6777 |

| Nova Scotia | Atchison & Denman 1-800-250-9059 |

| Ontario (except Ottawa) | ASAP Reporting Services Inc. 1-888-661-2727 |

| Ontario (Ottawa) | International Reporting Inc. 1-800-899-0006 |

| Price Edward Island | Atchison & Denman 1-800-250-9059 |

| Quebec | International Reporting Inc. 1-800-899-0006 |

| Saskatchewan | Royal Reporting Services Ltd. 1-800-667-6777 |

| Yukon | Royal Reporting Services Ltd. 1-800-667-6777 |

Following a hearing, parties can request a copy of a CD, or a recording of their hearing. In order to obtain this, one must be a party to a file. A request should be submitted to the Registry in writing, detailing the appeal number and the date of the hearing. An Undertakings form must also be signed and sent along with the written request. Once the request with the signed Form is received, a CD will be mailed. Please note at this time audio cannot be sent electronically.

When I Receive the Court's Decision

Further to the conclusion of the hearing, you will either receive an oral decision on the same day or at a later date. In any event, you will receive an official copy of the judgment by registered mail.

Appeal of the Court’s decision

If you decide to appeal the decision of the Tax Court, you may do so accordingly:

| Decision to be appealed | To which Court an appeal lies | Reference | Time Limit |

|---|---|---|---|

| Applications | |||

|

An Order with respect to an Application for an extension of time to serve an Objection |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.2), (1.3), (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

An Order with respect to an Application for an extension of time to institute an appeal |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.2), (1.3), (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

An Order with respect to an Application for a postponement of a period of suspension of authority to issue tax receipts under s.188.2(4) ITA (paragraph 18.29 (3)(b) TCC Act) |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.2), (1.3), (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

Application for extension of time to file an appeal at the Federal Court of Appeal |

A notice of motion must be served and then filed in the Federal Court of Appeal |

Federal Courts Act subsection 27(2) |

Within any further time that a judge of the Federal Court of Appeal may fix or allow before or after the end of those 30 days |

| General Procedure Appeals | |||

|

Judgment |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.1) & (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

Order (excluding orders related to applications for extension of time) |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.1) & (2) |

Within 10 days after pronouncement of decision |

|

Judgment / Order where the appeal is dismissed because the appellant failed to attend a hearing, status hearing or pre-hearing conference |

A motion to have the order of dismissal set aside and the appeal set down for hearing must be filed in the Tax Court of Canada |

Tax Court of Canada Rules – (General Procedure) subsection 140(2) |

Within 30 days after the pronouncement of the judgment or order |

|

Application for extension of time to file an appeal at the Federal Court of Appeal |

A notice of motion must be served and then filed in the Federal Court of Appeal |

Federal Courts Act subsection 27(2) |

Within any further time that a judge of the Federal Court of Appeal may fix or allow before or after the end of those 10 or 30 days, as the case may be |

|

Certificate of Costs |

A motion must be filed in the Tax Court of Canada |

Tax Court of Canada Rules – (General Procedure) section 159 |

Within 30 days of the date of a certificate of costs |

|

Extension of time for appealing the taxation of costs |

A motion must be filed in the Tax Court of Canada |

Tax Court of Canada Rules – (General Procedure) subsection 12 (2) |

An extension of time may be made before or after the expiration of the time prescribed |

| Informal Procedure Appeals | |||

|

Judgment |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.2), (1.3), (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

Order (excluding orders related to applications for extension of time) |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.1) & (2) |

Within 10 days after pronouncement of decision |

|

Judgment / Order where the appeal is dismissed because the appellant did not attend the hearing |

An application must be filed in the Tax Court of Canada |

Tax Court of Canada Act subsection 18.21 |

180 days after the day on which the order was mailed to the appellant |

|

Application for extension of time to file an appeal at the Federal Court of Appeal |

A notice of motion must be served and then filed in the Federal Court of Appeal |

Federal Courts Act subsection 27(2) |

Within any further time that a judge of the Federal Court of Appeal may fix or allow before or after the end of those 10 or 30 days, as the case may be |

|

Certificate of Costs |

An application must be filed in the Tax Court of Canada |

Tax Court of Canada Rules – (IT Informal Procedure) subsection 14(1) and (GST Informal Procedure) subsection 13(1) |

Within 20 days of the date of mailing of the certificate of taxation |

|

Extension of time for appealing the taxation of costs |

An application must be filed in the Tax Court of Canada |

Tax Court of Canada Rules – (IT Informal Procedure) subsection 14(2) and (GST Informal Procedure) subsection 13(2) |

The time may be extended by a Judge of the Court |

| Employment Insurance and Canada Pension Plan Appeals | |||

|

Final Judgment / Order |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.2), (1.3), (2) |

Within 30 days after pronouncement of decision in the calculation of which July and August shall be excluded |

|

Order (excluding orders related to applications for extension of time) |

An appeal must be filed in the Federal Court of Appeal |

Federal Courts Act subsections 27(1.1) & (2) |

Within 10 days after pronouncement of decision |

|

Judgment / Order where the appeal is dismissed because the appellant did not attend the hearing |

An application must be filed in the Tax Court of Canada |

Tax Court of Canada Act subsection 18.21 |

No later than 180 days after the day on which the order was mailed to the appellant |

|

Application for extension of time to file an appeal at the Federal Court of Appeal |

A notice of motion must be served and then filed in the Federal Court of Appeal |

Federal Courts Act subsection 27(2) |

Within any further time that a judge of the Federal Court of Appeal may fix or allow before or after the end of those 10 or 30 days, as the case may be |